Efficient accounting can streamline your financial record-keeping, reduce your costs and minimise your tax liability, but effective accounting does require attention to detail and accuracy. Furthermore, in-depth knowledge of the relevant taxation and revenue regulations is required in order to ensure you’re compliant with HMRC rules and regulations.

Whilst many dentists have a basic knowledge of their existing business structure and accounting methods, specialist expertise is usually required to ensure you’re operating as efficiently as possible in terms of your tax liability.

What is the structure of your dental practice?

Dental practices can be set-up in a myriad of ways, so establishing the best structure is the first thing you’ll need to do when addressing whether you’re operating in the most tax efficient way or not. You may be operating as a sole trader, as a partnership or as a limited company, for example. There are advantages to each of these structures, but downsides too. Ultimately, the right structure for your business will depend on your personal circumstances and needs, but each option will have a significant impact on your accounting and tax arrangements.

Depending on the size of your practice and its turnover, altering its current set up could help you to be more tax efficient.

In addition to this, the setup and structure of the practice may have an impact on remuneration and how this can be managed. If you’re a director of a company, for example, you may want to draw a salary, receive an income via dividends or opt for a combination of both. With help from an experienced dental accountant or tax adviser, you can find the most tax-efficient way to manage the way you extract money out of your business, as well as increasing tax efficiency from one year to the next.

Using your annual investment allowance

The annual investment allowance (AIA), enables companies to invest in capital expenditure without paying tax on the profits they’re using to finance these investments. If you are operating as a limited company, for example, and you have profits of £100,000, you would usually be required to pay tax of £19,000 on this (due to the current 19% corporate tax rate).

However, if you spend £20,000 of the £100,000 profit on capital expenditures, this is deducted from your profits before corporation tax is applied. The capital expenditure would, therefore, reduce your taxable profit to £80,000. At a rate of 19%, the amount of corporation tax you would be required to pay would be reduced to £15,200.

Of course, in order to reduce your tax liability in this way, your capital expenditure must be genuine and documented. As dentists do require a significant amount of costly equipment in order to operate, however, it’s not unusual for them to have a considerable rate of capital expenditures each year. Furthermore, investing in new equipment and technologies as capital expenditures can help you to operate more effectively and offer additional services to patients, which could make your practice more profitable in the long-term.

Taking advantage of the latest tax incentives

Dental accountancy requires you to be up-to-date with the latest legislation and regulations. As well as ensuring compliance, being aware of the latest tax protocols enables you to take advantages of the tax breaks on offer from HMRC and minimise your liability even future.

The annual investment allowance is usually capped meaning any capital expenditures exceeding this amount can’t be deducted from your taxable profits. The annual investment allowance is currently set at £1 million, meaning it’s a great time for dentists to make capital purchases they may have been postponing.

With the right accountant and professional advice, your dental practice can benefit from making financially savvy decisions at the right time. With in-depth knowledge of existing and upcoming changes to the rules of taxation, a specialist dental accountancy firm can provide you with specific advice in order to ensure you invest at the right time and take money from the business in the most appropriate and tax efficient way.

Combining NHS and private contracts

Accountancy for dentists can be complicated by the fact that they often work in accordance with various contracts. If you deliver NHS services as well as private dentistry, for example, you’ll need to examine how this affects the operations of your business and your tax liabilities.

If an employee, partner or director is entitled to maternity, paternity or adoption leave, for example, the income they receive during this period may be affected by whether they are operating under an NHS contract or a private contract. If you trade within a limited company and don’t have an NHS contract, for example, the rules governing statutory maternity, paternity and adoption pay may apply. For self-employed dentists with NHS contracts, however, NHS maternity and a maternity allowance may be available.

With varying tax considerations for dentists operating under NHS and private contracts or both, it’s easy to see why many practices end up paying more tax than they need to. Ensuring tax efficiency for dentists requires an in-depth knowledge of the specialist rules which apply to the industry, and not simply expertise in general business accounting or bookkeeping.

Digital accounting for dental practices

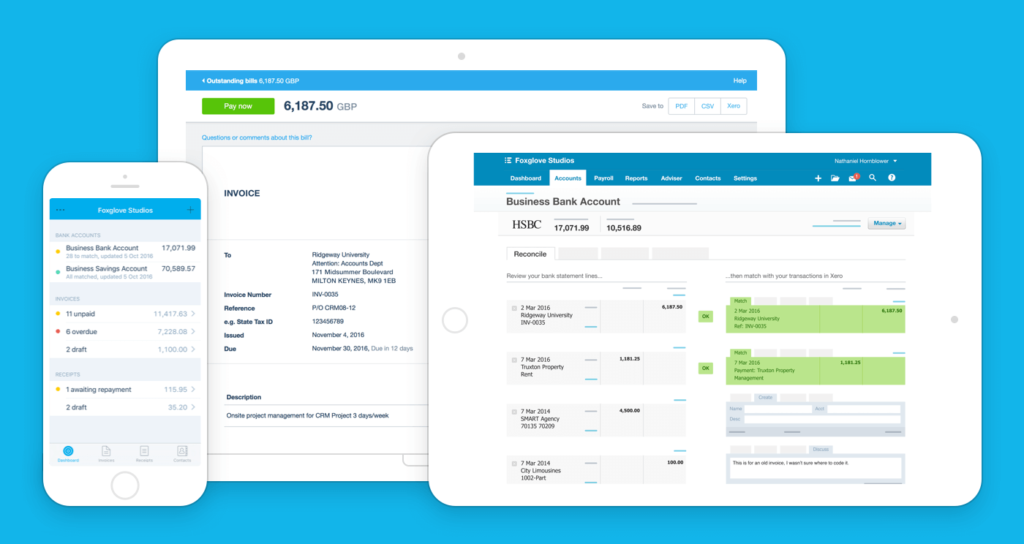

Although effective accountancy for dentists often has different requirements to non-regulated businesses, there is one area in which there are crossovers. Digital accounting has become increasingly commonplace in recent years, with HMRC even embracing the digital revolution through their Making Tax Digital initiative.

For dental practices, like other types of business, incorporating digital accounting practices can be extremely advantageous. As well as being more environmentally-friendly and helping your business to reach its carbon footprint reduction targets, using digital accounting software can reduce your costs, increase transparency and enable you to access swift accounting and taxation advice.

Traditionally, businesses tended to ignore their accounting needs until the end of their financial year loomed. In a bid to provide their accountant with the relevant documentation, old receipts and paperwork were frantically sought out and recovered, so that their accounts could be prepared in advance of the deadline. However, such practices are stressful for practice managers, business owners and accountants, and they could result in your tax liability being higher than it needs to be.

By opting to use digital accountancy software such as Xero, Sage or Quickbooks, your accounts can be kept up-to-date throughout the year and you can avoid the usual scramble to unearth receipts as your accounting deadline gets closer. Furthermore, as you can simply upload the relevant documentation when you log it into the system, you’re less likely to lose relevant paperwork. As a result, you can ensure that you claim for every expense that the business incurs, as opposed to missing out on tax relief when receipts have got lost or are unrecoverable.

Improving tax efficiency for dentists

Another major benefit of digital accountancy for dentists is that it provides you and your accountant with real-time financial information. At any time, you can login and see exactly how your business is performing. For dental accountants, this information can be extremely useful, as it can help them to assist you in creating a tax-efficient financial strategy.

Receiving an annual overview of your finances may suffice in terms of preparing your accounts ready for submission to HMRC, but it only provides limited and sporadic information in terms of your financial strategy. With on-going and regular access to a practice’s finances, accountants and tax advisers can take a more holistic view of the business. Using this information, they are able to provide more tailored and effective advice in relation to reducing your tax liability and improving your tax efficiency.

For dental practices of any size, obtaining specialist dental accountancy advice is crucial. When you access advice from an experienced dental accountant, you can ensure that your practice is operating with maximum tax efficiency and that you, your employees, partners or associates are benefiting as a result.

Contact us today for an initial consultation to talk about the most tax efficient accounting strategies for dentists – it costs nothing to start a conversation! We can give you guidance on how to setup your accounts in the easiest and most tax efficient way possible. Call us on 020 8872 9138 or request a callback here.